Car Loan Rates Philippines

The computation is indicative only and may change without prior notice. Purchase a brand-new or secondhand car SUV or van.

Metrobank S Car Loan Promo With Low Rates

While it is convenient to have your own car it can be a very expensive purchase that requires you.

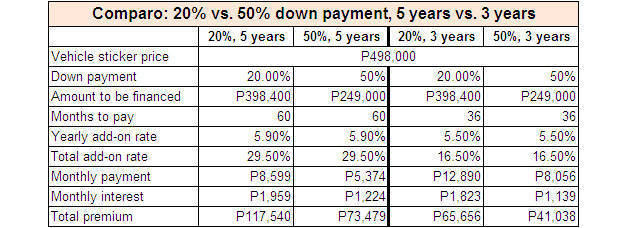

. Of course the longer the loan is the more interest youll have to pay in total. Key Car Loan Features in PSBank. Well explore this more in the next section.

Experience the future of banking with us today. Be honest with your financials. PLUS experience the following advantages.

Check PSBank car loan rates 8 Standard 558 to 2876. Make travels worry-free safe comfortable with your brand new car. Rates are subject to change.

Actual computations based on prevailing rates will be provided by your BDO Account Officer upon. Have your car loan application approved in as fast as 8 hours. Deep discounts are available for members who use the credit unions car buying service with rates starting as low as 229.

It is necessary to provide an income statement ID document and residence list. It could also be very helpful for your family or even when starting a business. Apply for car loan in the Philippines.

So the higher the rate the more you pay. Choose between Bank or Dealer Financing. No Commas Down Payment.

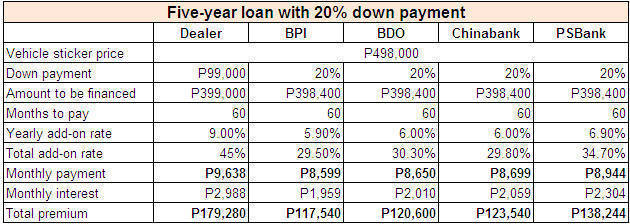

At one bank a 48-month loan has an add-on interest rate of 277 while a 60-month loan has an add-on interest rate of 361. Minimum of P 400000 for brand new and minimum of P 100000 for usedsecond hand vehicle. Increase your chances of getting money fill out a.

Get a car loan starting from P150000 up to 80 of the purchase price of the vehicle. Be aware that these lending rates are the lowest these institutions could offer. Loan Type 1yr Rate Fixing 3yrs Rate Fixing 5yrs Rate Fixing.

Apply car loans in Philippines from companies verified by our specialists. These do not constitute an approval nor an offer by BDO. All computations are for illustration purposes only.

With regards to the Maybank Car Loan interest rates the bank is implementing different sets of rates based on term on brand new vehicles and second-hand vehicles. Easy qualification requirements and no checking account or PDC needed. At PenFed rates for 36-month refinance loans start as low as 179.

Compute for a loan package that suits your budget. Get your dream car with PNB Auto Loan. Decide on the car you want to own.

Find the best payment option for you and your family. Minimum loan term of 3 years 36 months. Shop around and compare rates.

Minimum monthly household income. Pick the right loan term. Applicable to purchase and reimbursement of brand new vehicles for private and commercial use corporate facility.

On 15042022 you have access to 39 loans with a rate of 0 per day. On its official website Maybank has provided the list of the interest rates implemented under the said loan offer. Steps on How to Get a Car Loan in the Philippines.

All amount quoted are in Philippine Peso. Get advice from people who already got approved. 12 months 18 months 24 months 36 months 48 months 60 months.

The borrower should meet certain requirements to get successfully approved for the best car loan Philippines. To see the Auto Loan Rates. Start your journey now.

Brand-new and secondhand cars. A car loan implies an applicant earning at least PHP 5000 each month. 15 20 30 40 50.

An interest rate dictates the actual amount that you pay over the duration of your loan term. A car loan in the Philippines will provide you with your own convenient mode of transportation. For auto loan financing in the Philippines all auto loan interest rates are provided as a fixed rate.

Enjoy simpler and faster loan processing and avail of low interest rates. Rates used in the computation are for Metro Manila Accounts. Let EastWest Bank be your financial partner in purchasing your BRAND NEW or SECOND-HAND VEHICLE.

You may borrow as low as Php300000 or up to 80 of the price of your brand new car. With one-month advance 485 to 2770. Car loans of April 2022.

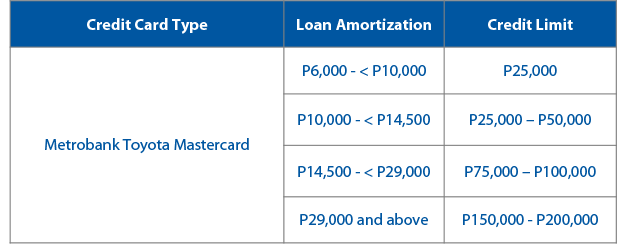

BDO offers a 1648 rate PSBank offers as low as 485 while the lowest rate is offered by BPI and Metro bank at 410. How to Compute an Auto Loan in the Philippines. Finance your vehicle for up to 6 years for brand new vehicles and up to 4 years for secondhand vehicles.

UnionBank of the Philippines is a multi-awarded universal bank regulated by the Bangko Sentral ng Pilipinas that provides superior financial products and customer experience. 12 to 60 months. Maximum loan term of 5 years 60 months Minimum down payment of 20 of the vehicles net selling price.

You may inquire from any Security Bank branch nearest you or call our Auto Loans Division at 4643000 locals 3111 3114 and 3509. How much is the loanable amount. The applicant should be at least 18 years old.

Minimum amount financed of P35000000. The interest rate is typically calculated as an annual percentage rate APR. Most banks in the Philippines have a loan calculator on their respective websites that you can use to estimate the cost of borrowing money for your car purchase.

BPI Family Auto Loan Calculator 4 Metrobank Car Loan Calculator 5 PSBank Auto Loan Calculator 6 Security Bank Car Loan Calculator 7. Get approved via non-appearance at 125 low. You can compute the cost by using the car loan calculator.

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

0 Response to "Car Loan Rates Philippines"

Post a Comment